The Inflation Reduction Act, a bill turned into a law after it was signed by President Joe Biden on August 16, 2022. The law is designed to address climate change and partly focused on tax credit for Electric Vehicle including PHEV in the US. The law introduces new rules that should be met to qualify as clean vehicle, and to be eligible for the EV tax credit. Basically, these rules aim to promote more battery and EV production in the US and balance job market during the ongoing transport electrification.

To qualify as a clean vehicle,

- a vehicle must have a battery capacity of at least 7 kWh and should meet the percentage requirements for battery components produced or manufactured in North America for the fiscal year the EV was purchased,

- should meet the percentage requirements for critical minerals extracted, processed and/or recycled in North America or a country the US has a free trade agreement with, for the fiscal year the EV was purchased,

- should have a gross vehicle weight rating less than 6342 kg,

- should be made by qualified manufacturer meaning, vehicles must be assembled in North America. In case the vehicles are assembled outside North America, it may qualify for the EV tax credit through commercial vehicle tax credit meaning, leased not purchased.

In addition, the vehicle’s manufacturer suggested retail price (MSRP) can’t exceed $80,000 for vans, sport utility and pickup trucks. For other vehicles the maximum limit is $55,000.

The law is being implemented, so tax credit qualifications continue to change and starting March 2023 further restrictions apply. As a result of this law, some vehicles that qualified for tax credits in 2022 may not qualify in 2023, creating uncertainties in EV & PHEV industry about the eligibility of the vehicle. However, one thing is for sure, if you are earning too much, for example, if your adjusted gross income for joint household is above $300000, your EV does not qualify for the tax credit.

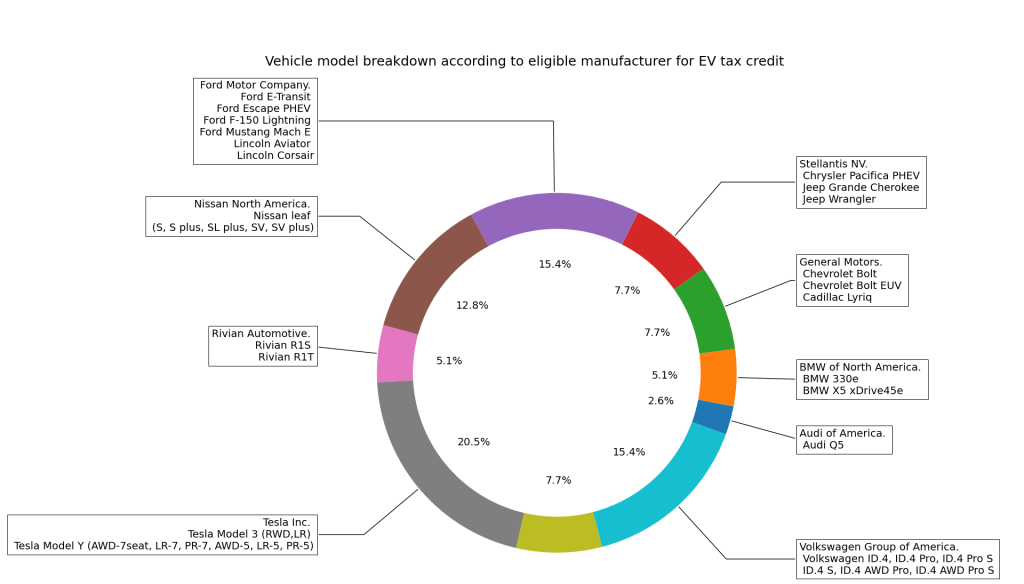

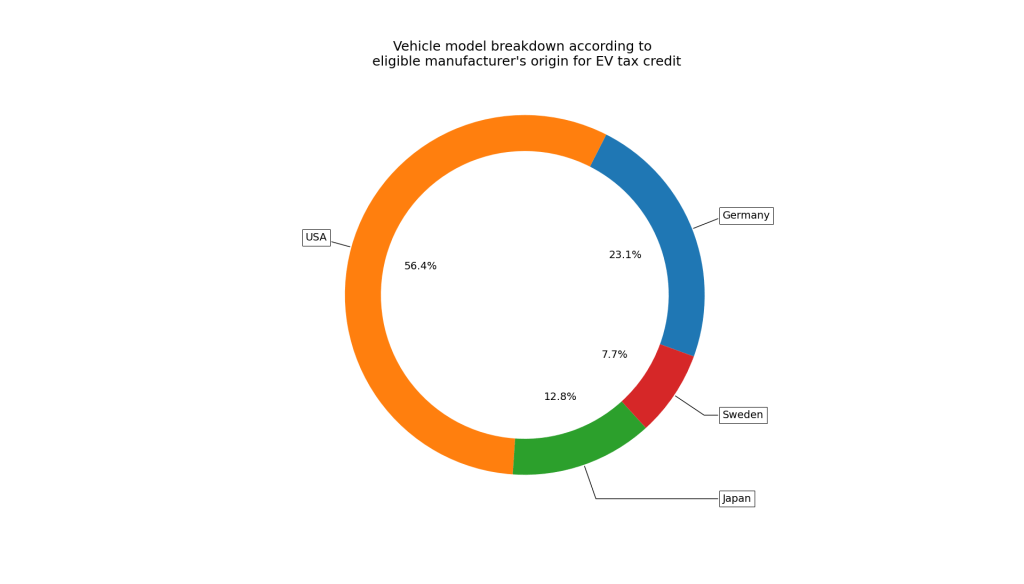

As of Jan 1, 2023, the list of eligible vehicles for tax credit is shown in Figure below.

It was a bit disappointing not to see some known electric car companies in the list, such as Lucid, Polestar and Toyota. However, the IRA has strengthened the US EV industry providing more benefits to American automakers and created competitive environment to grow. Now, it’s time to wait and watch how the market will adapt and react.

Comparing above eligible vehicles for EV tax credit, the most interesting, at least to me, is the one with similar range and power i.e. Ford Mustang Mach E RWD and Tesla Model 3 RWD. They both are full electric vehicle and falls under the category of <$55,000. Similar technologies, Ford Mustang with better power and Tesla Model 3 with better range. Food for thought!